Monster Beverage Corporation MNST is benefitting from the continued expansion of the energy drink market worldwide. This growth indicates a steady rise in consumer demand for energy drinks, providing a favorable environment for Monster Beverage to increase its market share.

Amid the favorable market trends, Monster Beverage's energy drinks segment has been the key contributor to its revenues. The company’s portfolio includes a diverse range of energy drink brands, leading to a 13.7% year-over-year increase in net sales for the Monster Energy Drinks segment in the third quarter of 2023.

Additionally, Monster Beverage has strategically adjusted its pricing in response to the ongoing inflationary cost pressures. These pricing actions are designed to balance the need to offset increased costs, while maintaining customer loyalty and demand. These efforts resulted in a gross margin expansion to 53% in the third quarter, an increase of 170 basis points, and a 22% year-over-year rise in operating income.

Product innovation has been a key driver of Monster Beverage's success. In the third quarter, the company launched its first flavored malt beverage alcohol product, The Beast Unleashed, in the United States, receiving positive feedback. The product is now available in 43 states, with plans for nationwide distribution. An extension of product line, Nasty Beast Hardcore Tea, is slated for release, targeting nationwide distribution in the first half of 2024.

Image Source: Zacks Investment Research

AFF Flavor Facility in Ireland Bodes Well

Monster Beverage’s AFF flavor facility in Ireland has been instrumental in enhancing operations within the EMEA region. By providing a large variety of flavors locally, the facility has improved service levels and reduced the landed costs of products in this region. This local production capability ensures faster and more efficient distribution, better inventory management, and potentially lower transportation costs, all of which contribute to improved profitability and customer satisfaction in these markets.

The ongoing plan to add a juice facility to the existing AFF flavor facility in Ireland represents Monster Beverage’s commitment to growth and diversification. This expansion is likely to further enhance the company's product offerings, potentially introducing product lines or enhancing existing ones.

Cost Hurdles

In the third quarter of 2023, Monster Beverage experienced a notable rise in the cost of sales, which amounted to $872.3 million, marking a 10.3% year-over-year increase. The company's operating expenses also saw a year-over-year increase of 13.8%. It is important to note that these operating expenses included $8 million of costs associated with the Bang Transaction.

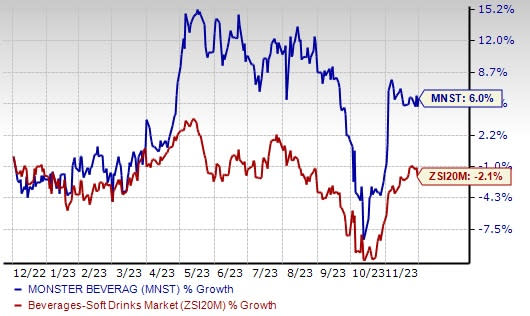

Shares of this Zacks Rank #3 (Hold) company have railed 6% in the past year against the industry’s decline of 2.1%.

Bet Your Bucks on These 3 Hot Stocks

We have highlighted three better-ranked stocks, namely The Vita Coco Company COCO, Dutch Bros Inc. BROS and Fomento Economico Mexicano FMX.

The Vita Coco provides a beverage platform. It currently sports a Zacks Rank #1 (Strong Buy).

The Zacks Consensus Estimate for The Vita Coco’s current financial-year sales and EPS suggests growth of 13.5% and 243.5%, respectively, from the year-ago reported figures. COCO has a trailing four-quarter earnings surprise of 25.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dutch Bros is an operator and franchisor of drive-thru shops, which focus on serving high-quality, hand-crafted beverages with unparalleled speed and superior service. The company currently sports a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Dutch Bros’ current financial-year sales and EPS suggests growth of 30.6% and 75%, respectively, from the year-ago reported figures. BROS has a trailing four-quarter earnings surprise of 57.1%, on average.

Fomento Economico Mexicano operates as a bottler of Coca-Cola trademark beverages. The company produces, markets, and distributes Coca-Cola trademark beverages. The company currently flaunts a Zacks Rank #2.

The Zacks Consensus Estimate for FEMSA’s current financial-year sales and EPS suggests growth of 32.3% and 60.3%, respectively, from the year-ago reported figures. FMX has a trailing four-quarter earnings surprise of 23.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vita Coco Company, Inc. (COCO) : Free Stock Analysis Report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

Dutch Bros Inc. (BROS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Bagikan Berita Ini

0 Response to "Can Monster Beverage (MNST) Keep Its Momentum Amid Cost Hike? - Yahoo Finance"

Post a Comment